Introduction

The performance of the US stock market is critical not only for investors but also for the global economy. Today’s trading marks significant movements amid ongoing geopolitical tensions and economic indicators. Understanding the market’s fluctuations is essential for investors seeking to navigate the current environment.

Market Overview

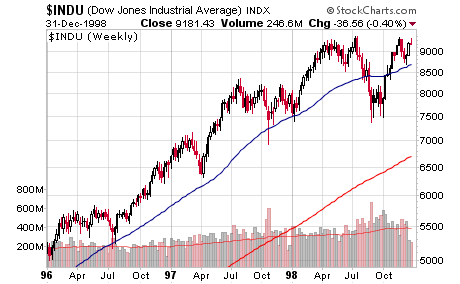

As of the latest trading session, the major indices of the US stock market have shown a mixed bag of results. The Dow Jones Industrial Average slightly dipped by 0.3%, while the S&P 500 gained 0.2%. The Nasdaq Composite performed best, posting a remarkable increase of 0.7%. These movements reflect current investor sentiments spurred by recent earnings reports and data releases.

Key Influencing Factors

Today’s shifts can be largely attributed to several factors:

- Economic Data Reports: Recent reports indicate that inflation rates are stabilizing, which has alleviated some fears of aggressive interest rate hikes by the Federal Reserve. However, investors remain cautious as core inflation data continues to show volatility.

- Corporate Earnings: Many significant companies have reported their quarterly earnings this week. While some tech giants surpassed expectations, others fell short, leading to varied stock responses and influencing overall market performance.

- Geopolitical Tensions: Heightened tensions in Eastern Europe continue to create uncertainty in global markets. Any sudden developments may provoke market reactions, making investors wary about keeping their positions.

Sector Performance

Certain sectors displayed notable performance today. The technology sector has driven the Nasdaq’s rise, with small caps also showing resilience. In contrast, energy stocks faced pressure due to fluctuating crude oil prices following OPEC’s recent decisions. Consumer discretionary stocks had a mixed performance amid varying consumer confidence levels.

Conclusion

As the US stock market continues to grapple with a complex array of challenges, including economic indicators and geopolitical events, investors are urged to stay informed. Analysts forecast that volatility may persist in the near term, as market participants remain sensitive to news and data releases. Today’s trading reinforces the importance of strategic investment and the necessity for a level-headed approach to market changes.