The Human Side of Health Care Investment

In the ever-evolving world of stock markets and healthcare innovation, the trajectory of UNH stock—shares of UnitedHealth Group—has sparked discussions not just among investors, but also within the communities that depend on its services. While financial analysts track numbers and trends, the real stories lie in the lives that are intricately woven into the fabric of this healthcare giant.

From Wall Street to Real Life: The Stakes

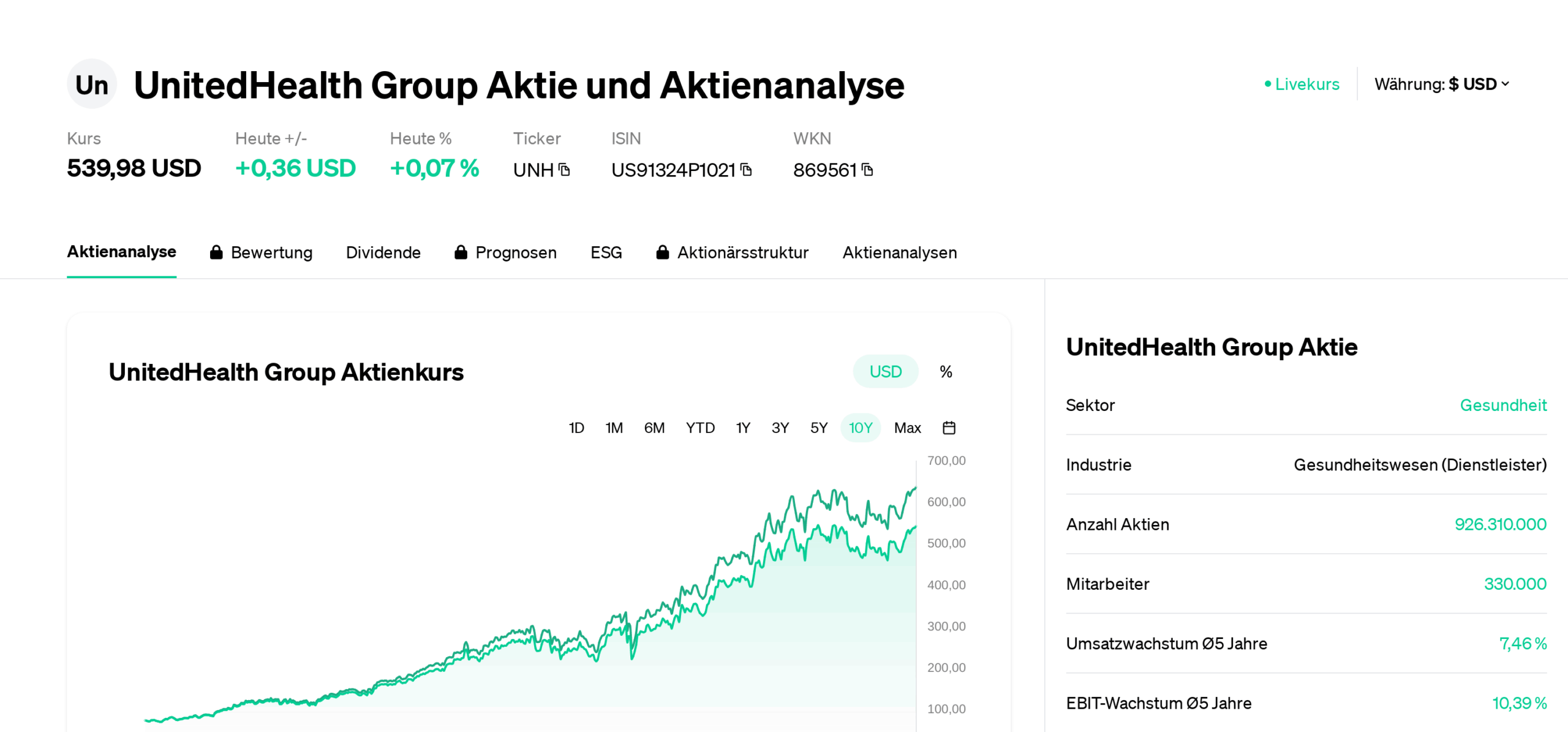

As of early October 2023, UNH stock has experienced fluctuations typical of the healthcare sector, showcasing resilience amid market volatility. Recently, the stock showed a significant upswing, reaching a closing price of $515. Investors are hopeful, tracking revenues that exceeded analysts’ expectations. Yet, behind these numbers, there are individuals whose lives are affected by the choices driven by such stock performances.

“Healthcare is not just a line item on a financial statement,” says Emily Curtis, a nurse in Toronto, who has witnessed firsthand the impact of UnitedHealth’s policies on patient care. “Every dollar their stock goes up can mean changes in practices, investments in technology, or even cuts that can affect the staffing we have on the floor.” The stock market’s momentum can ripple through hospitals, clinics, and the very patients in need of care, illustrating how closely intertwined finance and health can be.

The Broader Impact of UNH Stock Movement

The fluctuating value of UNH stock not only affects shareholders but also has broader repercussions in healthcare access, patient care quality, and insurance premiums. Market reactions to regulations and company disclosures often foreshadow shifts in approaches to nationwide healthcare challenges—something that communities across Canada are increasingly aware of.

On social media, stories of both optimism and skepticism emerge as users share their perspectives. A trending Twitter thread encapsulated this sentiment: “Do we invest in a healthier tomorrow, or just a wealthier today? UNH stock may rise, but what does that mean for us?” This duality underscores an emerging awareness of healthcare as a human right rather than just a commodity to be traded.

The Future of UNH Stock: A Mixed Bag

As the United States grapples with healthcare reform and Canada’s own system continues to face pressure, the actions of UNH will play a crucial role. Analysts predict that the stock will continue to perform well, thanks to ongoing innovations and partnerships within the digital health space. However, rising costs and potential policy changes may present hurdles that investors need to prepare for. The sentiment remains cautiously optimistic.

Emily Curtis expressed a shared hope among healthcare professionals, saying, “We want to see our companies invest in care, not just profits. We need a future where our community’s health comes first—stock prices should follow.”

Looking Forward

The journey of UNH stock serves as a microcosm of the healthcare system at large. With each uptick or drop, the implications stretch far beyond the confines of Wall Street. For the families who rely on UnitedHealth’s offerings, there exists a palpable anxiety tied to each financial report—they remind us that behind the stock are lives, stories, and a collective future. As market dynamics continue to play out, the challenge remains clear: to balance profit with purpose, ensuring that healthcare remains accessible and equitable for all.