Market Turmoil Hits TSM Stock Hard

In a tumultuous day for investors, TSM stock has experienced a significant drop, plummeting nearly 8% after a major financial analyst issued a sobering downgrade. This sudden decline raises alarms about the future of the semiconductor giant, as global uncertainties continue to ripple through the markets.

Details of the Downgrade

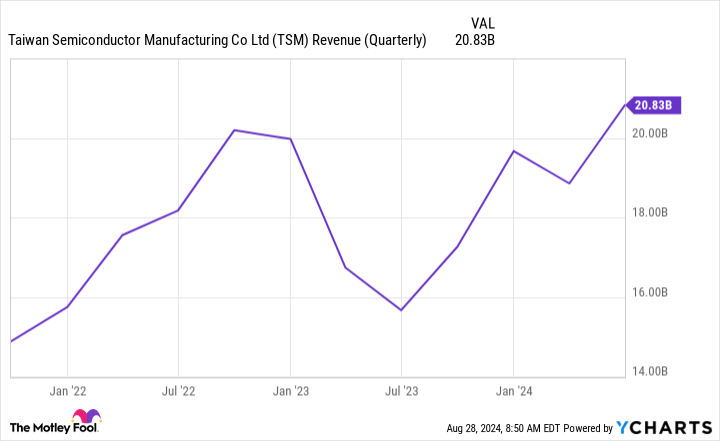

Goldman Sachs lowered its rating for TSMC from “Buy” to “Hold,” citing concerns over a slowdown in demand for semiconductors in the second half of 2023. The report highlighted the company’s challenges as supply chain disruptions continue to plague the industry, making it difficult for TSMC to maintain its previous levels of growth. “While TSMC is a leader in their field, the unsettlement in global trade and rising costs could dampen their momentum moving forward,” said Eric Wei, a financial analyst closely watching the sector.

Investor Reactions

As the news broke, investor sentiment took a sharp dive. In late trading, TSM stock was down to approximately $75 per share, down from a high of $81 just a few days earlier. Social media platforms lit up with sentiments of concern and disappointment. One investor tweeted, “I was holding onto TSMC for the long haul, but this downgrade is hard to swallow. What are the implications for the upcoming quarters?” Others discussed potential buy-in opportunities, hoping that the price may rebound in the future.

Global Market Context

The downgrade comes amid a backdrop of increased volatility in the tech sector, where competition and rising operational costs are creating uncertainty. Broader market indices are also feeling the pressure, with the NASDAQ Composite down over 3% on the same day. Analysts suggest that the semiconductor industry is at a turning point, one where adaptability and strategic sourcing will define the winners and losers.

Looking Ahead

As TSMC navigates these challenges, the outlook remains cautiously optimistic for the long term. Industry insiders believe that while short-term pressures are mounting, TSMC’s established market leadership and innovative capabilities may provide enough resilience to weather the storm. The upcoming earnings call in November could shed more light on the company’s strategies and outlook.

For now, investors will be watching closely. The fate of TSM stock appears inextricably linked to not just company performance, but also larger economic trends that show no signs of stabilizing anytime soon. As one analyst put it, “In these unpredictable times, a proactive approach could save investors a lot of heartache down the line.” For those currently invested, the coming weeks will be crucial.