When a Stock Buzz Turns Into a Rally

In the world of investing, few things capture the attention of stakeholders quite like a stock on the rise. Such is the case with IREN stock, a name that has become increasingly trending in recent months. IREN, short for Integral Energy, is not just a piece of paper traded on exchanges; it stands as a barometer of broader energy market shifts, encapsulating the challenges and innovations of the green energy transition. So, what’s driving IREN’s recent surge, and what might it signal for the future?

The Energy Landscape

The energy sector is undergoing a seismic shift, influenced by changing consumer preferences and global policies aimed at tackling climate change. Market sentiment around renewable energy stocks, including IREN, has been positively charged as nations reconcile their economic needs with environmental sustainability goals. “Investors are looking towards companies that not only promise growth but also align with an ecological ethos,” says Dr. Samantha Reid, an energy market analyst at GreenTech Advisors. “IREN has positioned itself well in this narrative.”

Financial Performance and Strategic Moves

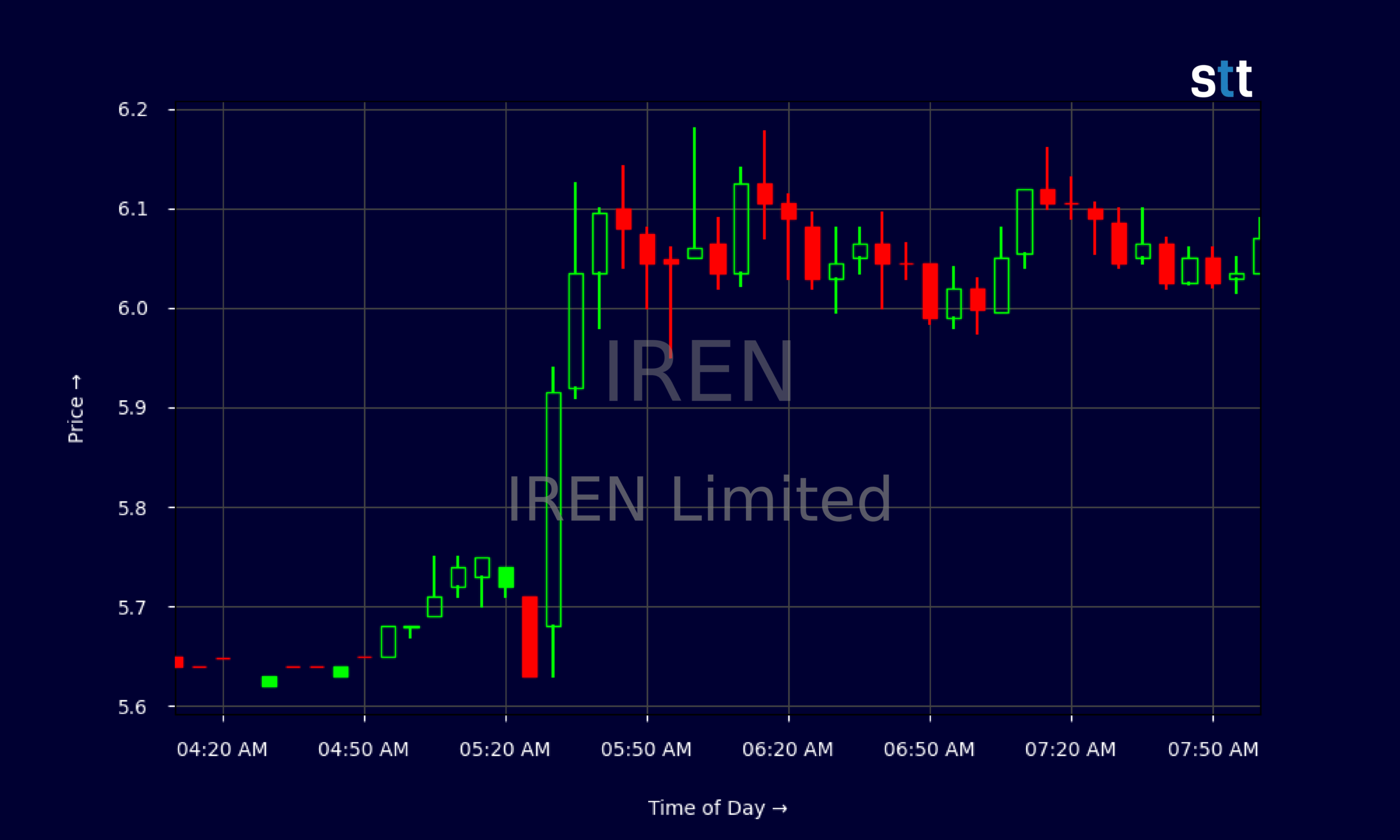

Recently, IREN stock saw a significant uptick following the company’s announcement of ambitious plans to expand its renewable energy portfolio. In the last financial quarter, IREN reported a revenue increase of 24% year-over-year, a testament to its successful investments in solar and wind technology. According to market analysts, robust earnings reports tend to buoy stock prices, and IREN is no exception.

Moreover, influential assessments have projected that IREN will continue to benefit from both macroeconomic factors—such as favorable government policies—and microeconomic maneuvers like cost efficiencies and strategic partnerships. Assets in renewable sectors are expected to yield higher returns as energy needs shift. “Many analysts have upgraded their forecasts for IREN stock because it demonstrates not only resilience but also adaptability during times of change,” Reid added.

Public Sentiment and Future Outlook

On social media, discussions around IREN stock have been buzzing, with many retail investors taking to platforms like Reddit and Twitter to share insights and celebrate their investments. In a recent thread titled “IREN to the Moon,” users showcased optimism, with sentiments predominantly favoring the stock’s potential. The fervor surrounding IREN is reminiscent of previous booms experienced by other renewable companies, capturing a wave of retail investor enthusiasm.

However, while excitement is palpable, caution remains. Industry experts warn that as IREN stock climbs, volatility may creep in. “The energy sector is notoriously cyclical and sensitive to external shocks, like geopolitical tensions or changes in regulatory frameworks,” says Dr. Reid. “Investors must remain vigilant and informed.”

A Shift in Paradigms

The rise of companies like IREN signifies a broader industry transformation toward sustainable practices, making it a crucial moment for investors to engage with the implications of climate change on financial markets. Potential dips shouldn’t scare long-term shareholders, given the overarching trends favoring renewable energy adoption.

As we navigate through this dynamic landscape, IREN stock stands out not just as a promising investment but as a symbol of the shifting paradigms in energy consumption. For those looking to invest, understanding the underlying factors driving IREN’s performance will be key to capitalizing on future opportunities.