Is the Latest Bitcoin Surge a Sign of Resilience?

The latest bitcoin surge has captured headlines and investor attention alike, revitalizing a market that experienced significant volatility over the past year. On October 10, 2023, the price of Bitcoin soared past the $35,000 mark, a level that many analysts consider a critical threshold. This fluctuation reflects not only the dynamic nature of cryptocurrency trading but also the broader economic factors influencing investor confidence.

Understanding the Factors Behind the Surge

Several factors appear to be driving this renewed interest in the latest bitcoin price movements. Institutional investment has shown a marked increase, with major financial players like Fidelity and Goldman Sachs integrating cryptocurrency into their offerings. Additionally, growing acceptance of Bitcoin in retail and commercial settings further strengthens its case. As Alex Tran, a cryptocurrency analyst from Toronto, notes, “The latest bitcoin rally demonstrates a shifting narrative; it’s not just a digital asset anymore, it’s gaining recognition as a significant part of the financial ecosystem.”

The Public Sentiment and Social Media Buzz

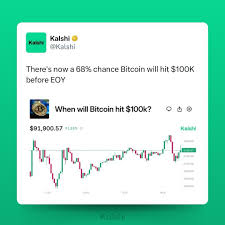

The social media landscape is abuzz with speculation and enthusiasm around bitcoin, igniting discussions on platforms like Twitter and Reddit. A staggering 62% of recent tweets about bitcoin have expressed optimism regarding its price trajectory, indicating a significantly positive public sentiment. This inflow of positive energy is crucial in a market often dominated by fear and uncertainty. Investors are sharing strategies, market predictions, and personal investment stories, fostering a community of enthusiastic proponents willing to ride the cryptocurrency wave.

Implications for Traditional Finance

With the latest bitcoin developments, traditional financial institutions must grapple with new realities. Cryptocurrency is gaining traction as an alternative asset class, creating both challenges and opportunities. Regulatory bodies are taking notice, and many are beginning to draft frameworks to better accommodate the integration of cryptocurrencies into mainstream finance. The implications for policy change could redefine banking practices and investment strategies across North America.

The Road Ahead: Challenges and Opportunities

While the latest bitcoin rally presents remarkable opportunities for investors, it also comes with challenges. Market volatility remains a concern, and regulatory scrutiny is likely to intensify as more people enter this arena. The role of technology in securing transactions and protecting investors’ interests can’t be overlooked amidst this frontier of financial innovation.

Investors considering diving into Bitcoin should weigh the implications carefully—historically, the crypto market can be as unpredictable as it is intriguing. On social media platforms, sentiments remain largely influenced by quick reactions to market news, which underscores the importance of thorough research before making investment decisions.

Final Thoughts

The latest bitcoin surge reflects broader economic trends and a growing acceptance of cryptocurrency as a viable financial instrument. As the market evolves and regulations catch up with the rapid advancements in technology, the future of bitcoin remains luminous for some and perplexing for others. Embracing this uncertainty could further solidify bitcoin’s standing as not just an asset but as a potential cornerstone of a reimagined financial landscape. Whether this is a passing trend or a new normal remains to be seen, but one thing is for sure: the bitcoin journey is just getting started.