Unpacking the Ups and Downs of NVTS Stock

The tech industry is not for the faint of heart, and NVTS stock is serving as a prime example of the exhilarating rises and nerve-wracking falls that characterize this sector. Over the last year, NVTS—a company specializing in innovative semiconductor solutions—has seen its stock price swing dramatically, leaving investors on a roller coaster ride of emotions.

Recent Performance and Market Drivers

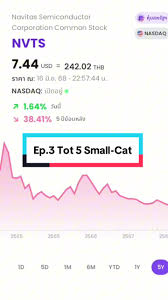

As of late October 2023, NVTS stock has fluctuated between CAD 34 and CAD 58. In a world where technology continues to dominate our lives, this volatility could lead one to wonder—what’s behind it? Analysts point to a confluence of factors: market demand for semiconductors remains high but is increasingly competitive, while recent supply chain disruptions have created a volatile trading environment.

In a recent conference call, CEO Jessica Mills remarked, “While we’ve made significant strides in our product development and market reach, we can’t ignore the challenges posed by global supply issues. These challenges create turbulence for our stock, but our fundamentals remain strong.” This statement reflects a resilience that many investors are hoping will translate into a stable future for NVTS.

Investors’ Reactions and Sentiments

On social media platforms and investment forums, markets are abuzz with speculation regarding the stock’s next move. According to data collected from social media analytics, NVTS stock has garnered mixed reactions among retail investors. While some underscore the potential for recovery, others express frustrations about the unpredictable nature of its movements. Twitter user and self-proclaimed investment guru @TechieInvestor wrote, “Buying NVTS stock feels like riding a bull at a rodeo—exciting but you better hold on tight!”

Beneath the surface, the concern surrounding NVTS stock may indicate a larger issue within the tech market at large. If NVTS cannot smooth out its volatility to attract a stable investor base, it risks being relegated to a lesser status among semiconductor firms. This sentiment is echoed in discussions from seasoned traders who are wary of overextending themselves on stocks that lack coherent linear growth.

The Broader Implications for the Tech Market

The ongoing fluctuations of NVTS stock may serve as a microcosm of the overall tech market in Canada. As smaller companies like NVTS struggle for market share against industry giants, they often find themselves experiencing the brunt of price swings. Increased competition and the looming threat of regulatory changes add additional layers of complexity to the investing landscape.

In light of this volatility, tech investors are urged to conduct thorough market research while remaining vigilant about potential shifts that could impact their portfolios. As we look forward, the question on everyone’s mind is not just what will happen to NVTS stock but how these trends will shape the future of the technology industry in Canada.

Looking Ahead

While NVTS stock remains a captivating topic of conversation among investors, the next few months will be critical. Will the company weather the storm and emerge more robust, or will the waves of volatility prove too challenging? As the tech landscape evolves, understanding NVTS stock will be essential not just for immediate gain but for long-term positioning in an industry that changes with remarkable speed.