Introduction: The Aerospace Shift

As the aerospace sector continues to transform, one company that has taken center stage is Rocket Lab USA, Inc. (NASDAQ: RKLB). The company is not only attracting attention for its innovative launcher systems but also for the volatility in its stock, rklb. This article delves into the dynamics influencing rklb stock, examining market sentiment, expert insights, and what the future might hold for investors.

The Growth of Rocket Lab

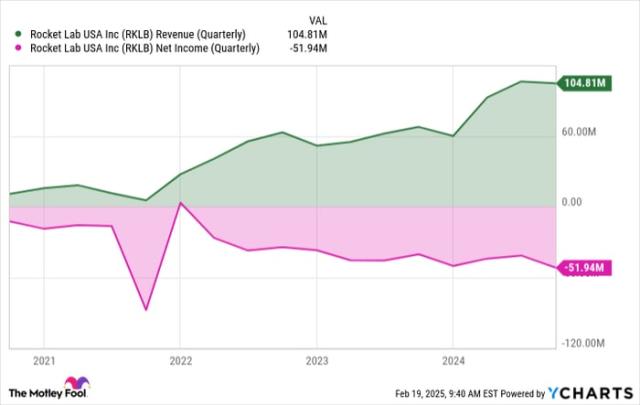

Founded in 2006, Rocket Lab shifted the paradigm of the space industry with its Electron rocket, designed for small satellite launches. Since going public in 2020 through a merger with a special purpose acquisition company (SPAC), Rocket Lab has seen its rklb stock fluctuate significantly. Investors have been drawn to the potential of the burgeoning satellite industry, but they have also faced challenges, including rising costs and competition.

Market Trends and Stock Performance

As of late October 2023, rklb stock is showing signs of recovery after a notable dip earlier in the year. Following the company’s recent announcements about expanding its launch capabilities and developing new technologies for heavy-lift missions, there has been a rejuvenated investor optimism. “The current trajectory of Rocket Lab suggests a promising opportunity for thoughtful investments,” remarked Dr. James Whitaker, an aerospace analyst at Marketgate Capital. “Their ability to pivot into the heavy-lift segment is creating new avenues for revenue.”

Statistics reinforce this sentiment. The stock has climbed approximately 25% over the past month, a noteworthy rebound when set against the backdrop of a broader market downturn. The sentiment from retailers on platforms like Reddit and Twitter has also grown increasingly favorable, with many users discussing potential price targets that range from $10 to $15 per share, as bullish enthusiasm spreads.

Risks and Challenges Ahead

Despite positive projections, challenges loom on the horizon for rklb stock. The aerospace market is inherently unpredictable, marked by geopolitical tensions and supply chain constraints exacerbated by global conditions. Analysts caution that while Rocket Lab’s innovations are promising, they still contend with robust competitors like SpaceX and Blue Origin, which possess extensive resources and market experience.

Public Response and Investor Sentiment

Social media has played a crucial role in shaping public perception of rklb stock. Conversations on Reddit’s r/wallstreetbets and Twitter have highlighted both excitement and skepticism regarding the company’s ability to venture into the more competitive heavy-lift market. User comments oscillate between hope and caution, reflecting the dual nature of investing in high-stakes sectors such as aerospace. One user noted, “Rocket Lab’s move into heavy-lift could be a gamechanger, but can they really compete with the likes of SpaceX?”

Conclusion: Horizon Ahead

The ongoing conversation surrounding rklb stock indicates a complex interplay of hope and apprehension among investors. With the aerospace industry poised for expansion, and Rocket Lab positioning itself as a key player, the next few quarters will be crucial in determining the trajectory of its stock. For progressive investors, understanding the risks alongside potential rewards will be essential in navigating the skies ahead.