JPM Stock Shows Resilience After Strong Q3 Earnings

In a week marked by volatility in the financial markets, JPMorgan Chase & Co. (JPM) reported a promising third-quarter earnings report that has significantly boosted investor confidence. As of the latest trading session, JPM stock has risen by over 3%, driven by better-than-expected revenue and profit margins that outshine many of its banking peers. Analysts are now watching closely to see if this upward trajectory can be sustained.

Key Financial Highlights

On October 13, JPMorgan unveiled its Q3 financial results, revealing a net income of $10.4 billion, or $3.33 per share, beating analysts’ expectations of $3.00 per share. The bank credited increased consumer spending, improved loan demand, and manageable operating expenses as key factors in its robust performance. The total revenue of $39.9 billion represented a 17% year-over-year increase, signaling a solid recovery amidst ongoing economic uncertainty.

Market Reactions

The reaction to the earnings report has been overwhelmingly positive. Investors took to social media, expressing their enthusiasm. One trader tweeted, “JPM has proved again why it’s the leader among big banks. Strong fundamentals and impressive growth! #JPMStock”. This sentiment has contributed to a surge in trading volume, with many seeing JPM stock as a safe and strategic choice in a tumultuous market.

Analysts Weigh In

Wall Street analysts have reacted to the latest data by adjusting their projections for JPM stock. “JPMorgan continues to exhibit strong operational prowess. Their diversified revenue streams and adept cost management put them in a unique position as we move into 2024,” commented investing analyst Sarah Ramirez. She believes that the bank’s well-managed risk profile enables it to better weather potential economic storms in comparison to its sector counterparts.

Outlook for JPM Stock

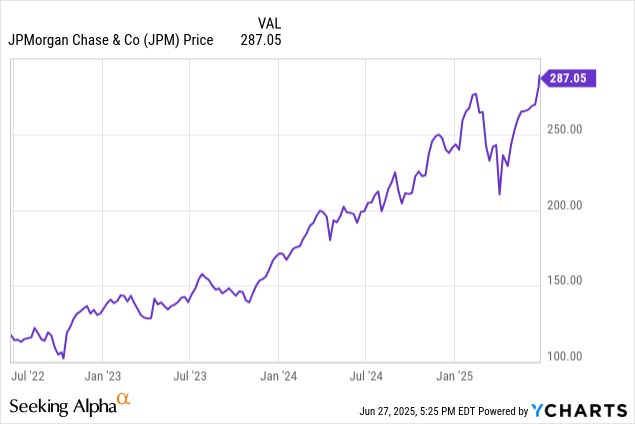

With earnings season underway and the Fed’s monetary policy under scrutiny, the road ahead for JPM stock remains cautiously optimistic. While uncertainties linger in the wider economy—especially with inflation figures still unpredictable—investors are hopeful that JPMorgan’s proactive strategies and solid capital reserves can navigate potential headwinds. As of today, JPM stock is trading around $135, with analysts suggesting a price target of upwards of $145 within the next 12 months, contingent on sustained growth and effective risk management.

Investor Strategies

For individuals considering investing in JPM stock, experts suggest keeping a close eye on quarterly earnings calls and macroeconomic indicators. Some analysts encourage a buy-and-hold strategy, citing the bank’s resilient dividends and strong growth strategy. Meanwhile, others advise caution, underscoring the importance of evaluating one’s personal financial goals before diving into any stock investments.

Final Thoughts

As the financial landscape continues to evolve, JPMorgan Chase & Co. stands out as a key player in the banking sector. JPM stock’s performance following the recent earnings report reflects broader market confidence, but continued vigilance will be essential as investors navigate the changing tides. The upcoming months could further reveal whether this current rise is sustainable or merely a temporary uptick.