The Rising Tide of Inflation

In the midst of an economy teetering on the edge of uncertainty, inflation has emerged as a critical concern for Canadians looking toward 2025. As households navigate the rising cost of living, the implications of inflation extend far beyond mere numbers on a balance sheet — they ripple through communities, feeding anxiety and altering aspirations.

Real Lives Affected

Take for instance, Sarah Jackson, a single mother of two from Calgary. With gas prices soaring and grocery bills climbing, Sarah has had to make tough decisions about her family’s diet and activities. “I can’t remember the last time I treated the kids to a meal out. We’ve been eating at home more than ever, just to save money,” she reflected. Such sacrifices are becoming all too common as families contend with inflation that many fear is becoming entrenched.

Financial Stability at Risk

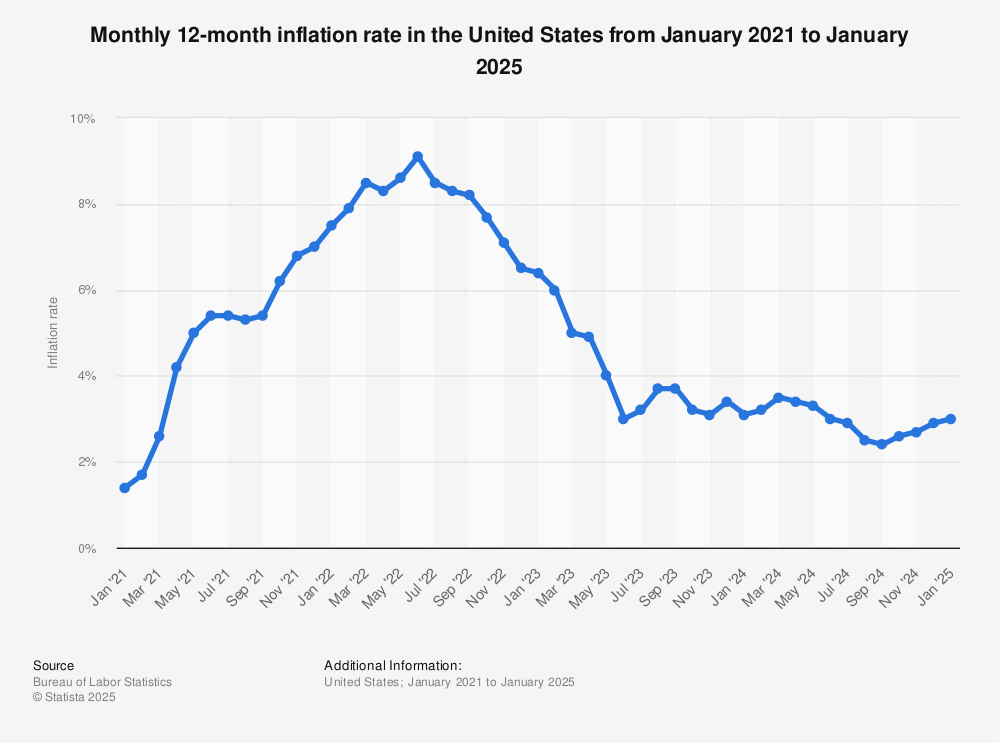

The Bank of Canada recently projected inflation rates could hover at around 5% for the next couple of years before easing to a target rate of 2% by 2025. Yet this forecast has left financial analysts and average Joe’s alike on edge, desiring reassurances that the situation won’t spiral out of control. In a country where wages haven’t kept pace with rising prices, many wonder how to plan for the future.

Impact on Savings and Investments

As inflation 2025 looms ominously in the distance, Canadians are adjusting their financial strategies. Investment advisor John Sinclair observes a shift in mindset. “We’re seeing people pull back from stock market offerings in favour of cash reserves. The unpredictable nature of inflation right now is steering many to rethink their risk tolerance.” With savings accounts yielding minimal interest, the real value of hard-earned money is eroded by inflation, leaving people feeling less secure.

Public Sentiment

Online forums and social media platforms are buzzing with conversation regarding inflation’s impact. Hashtags like #Inflation2025 and #CostOfLivingCrisis are trending as individuals and families share their experiences and tips for managing in an environment of rising costs. Some are advocating for price controls or government intervention, while others express a sentiment of helplessness, questioning if their voices are being heard.

Looking Ahead

As 2025 approaches, the interactions between government policy, consumer behaviour, and global economic factors will be paramount in determining the course of inflation. Whether Canadians will see a return to financial stability or be forced to adapt to a “new normal” marked by sustained inflation remains to be seen.

A Call for Change

The conversation surrounding inflation isn’t merely about numbers — it embodies the hopes and fears of countless Canadians. As they navigate their everyday lives, individuals like Sarah remind us that the wider implications of inflation reside in the human experience. Stronger support systems and proactive policies will be essential to ensure that the financial future being shaped today leads to a more equitable tomorrow.