Sudden Turn of Events in the Tech Market

In a shocking turn of events, Googles stock (GOOGL) has suffered a significant decline, dropping over 6% in early trading on Monday, as investors grapple with growing concerns surrounding the broader tech sector. This abrupt downturn comes amid escalating economic fears, leaving stakeholders anxious about the future viability of major tech players.

Investor Sentiment Takes a Hit

The stock market opened lower today, with the tech-heavy NASDAQ index also seeing a notable decline of approximately 4% in the opening hour. Concerns about inflation, interest rates, and potential regulatory action against large tech companies have fueled investor hesitation. The fast-paced digital landscape has also seen a surge in public scrutiny, leading to an increasingly pessimistic outlook on stocks like Googles.

Many analysts are attributing this decline to a confluence of factors, including disappointing earnings reports from key industry players. “The tech sector is currently in a vulnerable position, and Googles stock is reflecting those worries,” said Andrew Wang, a senior analyst at TechInsights. “The uncertainty surrounding future growth and rising interest rates is forcing investors to reevaluate their positions.”

Social Media Reaction and Public Opinion

Public sentiment has ranged from panic to skepticism. On platforms like Twitter and Reddit, users are debating whether this dip represents a buying opportunity or a sign of deeper trouble ahead. “I’ve seen better days,” tweeted one frustrated investor. “Googl stock was stable before; I’m not sure what’s happening now.”

A sense of confusion is palpable, as some market watchers believe the dip is merely a short-term setback, while others fear it could signify an impending recession. In sharp contrast, some investors are leveraging the dip to purchase more stock, believing in Googles long-term potential for recovery and growth.

Looking Ahead: What’s Next for Googl Stock?

As Wall Street analysts scramble to adjust their forecasts, the coming weeks could be pivotal for Googles stock. With the company due to announce its quarterly earnings later this month, investors are keen to hear updates on advertising revenue and overall company performance. Given that advertising accounts for a significant portion of Googles earnings, analysts will be closely scrutinizing these figures for any signs of resilience or further declines.

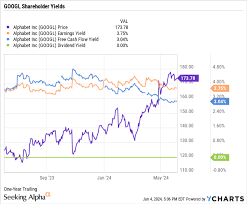

“Even amidst this turbulence, we believe Googles strong cash flow and dominant market position will provide a cushion,” noted Wang. “However, sustained economic pressure could create significant challenges going forward.”

The Bottom Line

The tech sector is at a watershed moment, and Googles stock embodies the immediate crisis facing investors. As market dynamics continue to evolve, all eyes will be on the upcoming earnings report, which could dictate the company’s trajectory in the volatile landscape.

For investors, the next move is critical: will they hunker down and ride out the storm, or look to seize opportunities as they appear on this volatile journey?