The Rollercoaster Ride of GME Stock

In the unpredictable world of stock trading, few names have captivated investors like GameStop Corp., known colloquially as GME stock. Once dismissed as a dying retailer, GameStop emerged as a symbol of the retail investor’s power. The volatility of GME stock has sparked debates, ignited social media, and even raised questions about the ethics of short selling.

What Fueled the Latest Surge?

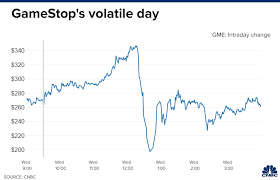

Recently, GME stock made headlines again by surging nearly 50% in a single day, leaving many investors and market analysts scrambling to make sense of its resurgence. This dramatic increase has been attributed to a combination of retail investor enthusiasm, support on social media platforms, and speculation surrounding the company’s shift towards e-commerce.

GameStop has been actively restructuring its business model, pivoting from traditional brick-and-mortar sales to online strategies—something investors are beginning to take note of. Analyst Lisa Chen stated, “The company has a chance to reinvent itself for the digital age, and investors are beginning to explore the potential rewards of that transformation.” This sentiment has been echoed across social media platforms like Reddit, where a community of retail investors continues to rally around the stock.

The Retail Investor’s Impact

The latest rally can largely be attributed to a community of retail investors who communicate actively on platforms like Reddit’s WallStreetBets. The subreddit has become a digital battleground for stock discussions, influencing mainstream market trends. The power of collective action among individual investors has made GME stock a case study in the capabilities of grassroots movements within financial markets.

Public reaction has been polarized. Some see GME stock as a beacon of hope for retail investors, while others criticize the speculative trading as reckless. “It’s great to see retail investors banding together, but there’s a fine line between enthusiasm and dangerous speculation,” cautioned financial analyst Jordan Reed. The recent surge has also reignited conversations about the ethics of short selling and the transparency of the financial market.

Market Predictions and Future Considerations

As we enter Q4, GME stock is under close scrutiny. Predictive modeling indicates that while there may be short-term volatility, the stock’s longer-term prospects will depend heavily on how well GameStop executes its business strategy. Recent statistics show that the stock is still 70% down from its all-time high in January 2021, raising questions about whether this current surge is sustainable.

Investors must tread carefully. While GME stock has the allure of quick profits, the risks associated with such volatility cannot be overstated. The balance between fandom and financial prudence will likely dictate its future trajectory.

The Final Analysis

The saga of GME stock is far from over. With retail investors directly influencing market dynamics, the future looks unpredictable but exciting. The rise and fall of this digital-age company will serve not only as a financial lesson but a cultural phenomenon illustrating the shifting power dynamics within stock markets.