From Memes to Millions: The GME Revolution

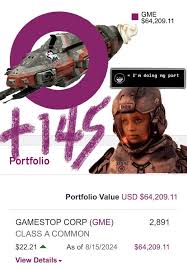

On a chilly January day in 2021, the stock of GameStop (GME) took a meteoric rise that would capture the attention of retail investors and Wall Street alike. A seemingly ordinary video game retailer became the symbol of a financial revolution, igniting conversations about power dynamics in investing and the influence of social media.

The Retail Investor’s Awakening

What started as a group of Reddit users on the r/WallStreetBets forum sharing memes soon escalated into a phenomenon that left institutional investors scrambling. The rally was not just about a stock; it was about the empowerment of individual investors willing to challenge traditional norms. “It was like a financial David and Goliath story, where the little guy had a chance to take down the giants,” explained Drake Chen, an avid investor from Toronto who attributes his newfound financial confidence to GME.

Social Media: The Game Changer

Social platforms played a pivotal role in the GME saga, transforming the way retail investors communicated and shared insights. Tweets, TikTok videos, and Reddit posts became essential to the collective consciousness of this movement. The hashtag #GME was flooding social media feeds, with users rallying together, sharing tips, and dissecting market trends. Recent statistics show that retail trading volume surged by 200% during that fateful month, proving the power of social media in influencing financial markets.

A Community of Support

But beyond the dollars and cents, GME fostered a unique community. Investors formed bonds over their shared experiences—some made massive profits, while others faced significant losses. Yet the collective spirit remained steadfast. “We were in it together, sharing not just money but stories, heartbreaks, and victories,” recalled Chen, reminiscing about the friendships formed within the fray.

Long-Term Implications and Changing Mindsets

The GME phenomenon didn’t just impact the stock price; it redefined a generation of investors. It’s led to a growing interest in financial literacy, with more individuals seeking out information and resources than ever before. A recent survey indicated that 64% of Canadians aged 18-34 now consider financial education a top priority. The realization that participation in the stock market isn’t confined to the wealthy has sparked a greater interest in investing among younger generations.

The Road Ahead

As we look to the future, the legacy of GME will continue to unfold. New financial regulations are being discussed, aimed at leveling the playing field and ensuring fairness in the markets. Institutions are now more cautious, and retail investors have developed a sense of resilience and strategy. While the thrill of rapid gains may not last forever, the empowerment and sense of community fostered during those unprecedented days will undoubtedly remain.

In the wake of GME, investors are learning that the stock market isn’t just an abstract system but a human landscape filled with risks, rewards, and personal stories.