Baba Stock Volatility Continues

Shares of Alibaba Group Holding Limited, commonly referred to as baba stock, have been on a tumultuous ride lately, reflecting the broader challenges in the Chinese tech sector. As regulatory scrutiny tightens, investors are grappling with uncertainty, leading to substantial fluctuations in the stock’s price.

Regulatory Challenges Ahead

Recent announcements from China’s government regarding stricter regulations on technology companies have sent shockwaves through the markets. With Alibaba being one of the largest players in the arena, the impact has been particularly pronounced. On Monday, baba stock plummeted 7% in a single trading session, a clear indication of investor apprehension. Analysts point to a recent report that showed a potential crackdown on data monopolies, which could affect Alibaba’s robust e-commerce ecosystem.

Investor Sentiment and Market Reaction

Despite the declines, some investors remain optimistic. “I believe in Alibaba’s long-term potential. The company has consistently adapted to changing regulatory landscapes, and I expect it to do so again,” said Iris Chen, a market analyst based in Toronto. This sentiment echoes among a cohort of long-term investors who see the current downturn as a buying opportunity.

On social media, the mood is mixed. While some Twitter users express frustration with the volatile nature of baba stock, others find solace in the notion that Alibaba’s fundamentals remain solid. The stock has dipped sharply from its highs, which has only amplified discussions about its recovery prospects.

Financial Performance and Future Prospects

In its latest earnings report, Alibaba showed resilience with a revenue increase of 10% from the previous year, boasting strong performance in the cloud computing sector. However, analysts are warning that regulatory pressures could interfere with future growth. “If Alibaba can navigate these challenges effectively, we might see a stabilization in its stock price,” mentioned equity analyst Brian Wu in a recent podcast.

What Lies Ahead

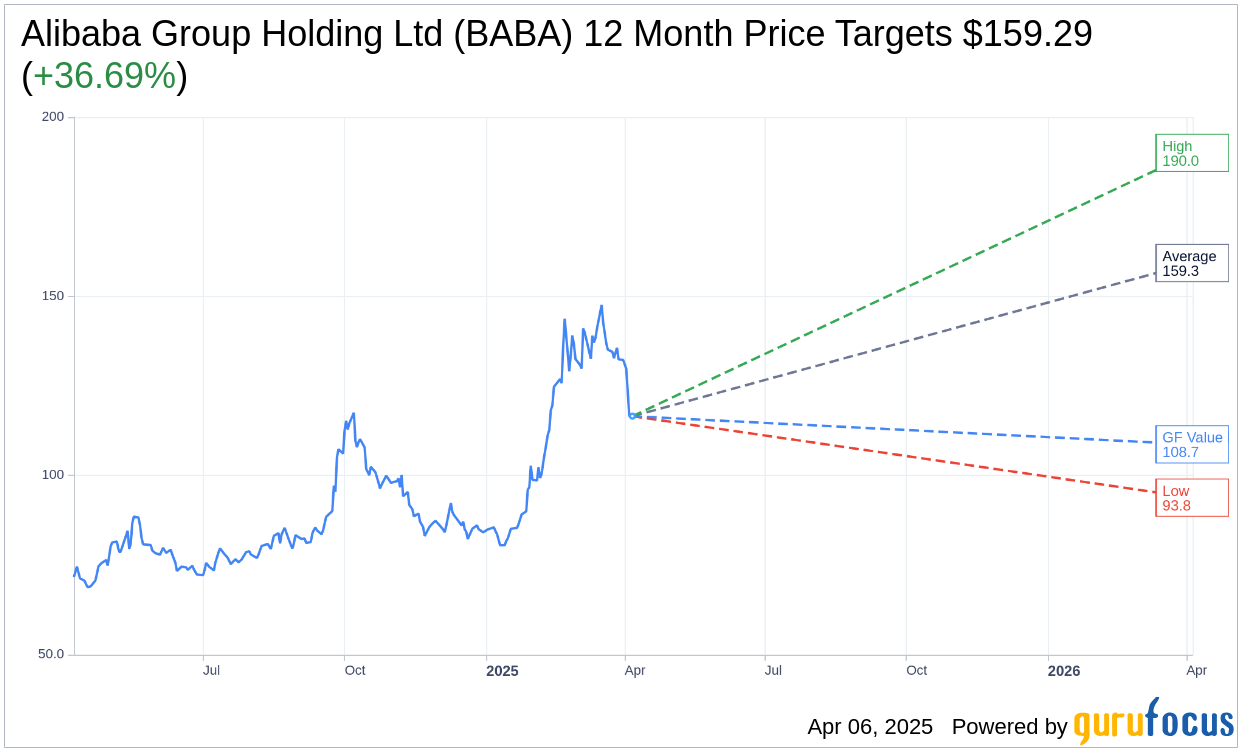

Looking forward, baba stock appears poised for a rocky road as it navigates the intricacies of governmental regulations and market expectations. Investors will be keenly watching the upcoming earnings call for more insights into how Alibaba plans to address these challenges. Increased transparency and a clear path forward could help restore confidence in the stock.

As Alibaba continues to face scrutiny, both globally and domestically, one thing remains clear: the eyes of investors are glued to baba stock, awaiting signs of recovery amidst the pressures of an evolving regulatory landscape.