Building Blocks of Security

The Canada Pension Plan (CPP) has become synonymous with financial security in the later years of life for millions of Canadians. Established in 1966, it serves as a fundamental safety net for retirees across the nation. But what does it mean to those who are about to retire or have recently done so? For many, the CPP is more than just a series of numbers on a statement; it represents peace of mind during their golden years.

Personal Stories and Collective Sentiment

As the baby boomer generation moves into retirement, stories abound of individuals who relied on the CPP as a crucial pillar of their financial stability. Take Linda Mathews, a 67-year-old retiree from Montreal, for instance. “When I look at my monthly pension deposit, I feel a huge weight lift off my shoulders. I know I have a steady income, and I can finally enjoy life after 40 years of hard work,” she expressed. For Linda and others like her, the CPP isn’t just an old-age benefit; it’s an essential part of their financial planning.

Stats and Trends

Recent statistics reveal the growing role of the CPP in Canadians’ retirement plans. According to the Canada Pension Plan Investment Board, in 2022 alone, more than 6.7 million Canadians received CPP benefits, averaging around $1,200 per month. With the cost of living seeing unprecedented increases in recent years, many Canadians are grappling with financial uncertainty. In fact, a recent poll indicated that 63% of Canadians believe the CPP will be their primary source of income after retirement—a sharp rise from previous years.

Pension Reform and Future Outlook

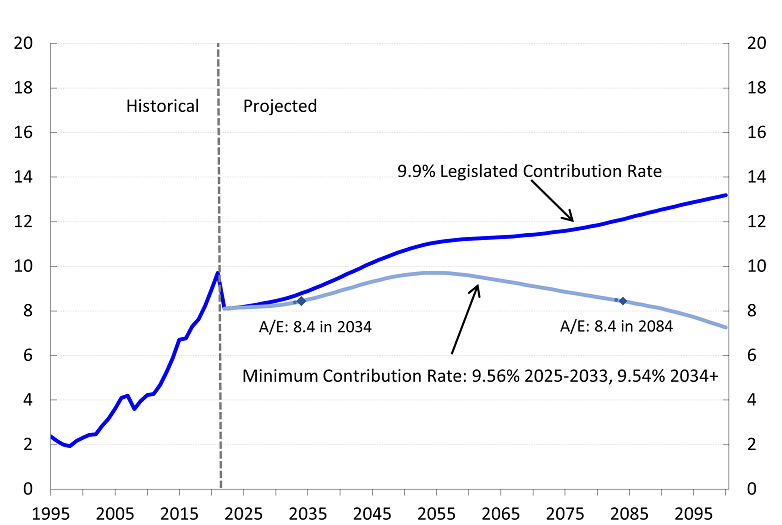

As Canada edges towards a more diverse and dynamic workforce, the question arises: will the CPP be enough to sustain retirees in the decades to come? Advocates for pension reform emphasize the need for enhanced benefits that can adapt to shifting economic realities and demographic changes. “If we do not evolve the CPP, we risk leaving future generations struggling to make ends meet,” warns financial analyst Ryan Chen. Social media conversations surrounding the adequacy of the CPP highlight fears and hopes for the future, with some calling for increased contributions and expanded payouts.

A Collective Responsibility

The conversation surrounding the Canada Pension Plan transcends individual experiences; it is a national dialogue about values, social responsibility, and financial foresight. As Canadians prepare for the next wave of retirements, the relevance of CPP as a key income source cannot be overlooked. The importance of solidarity in supporting the CPP system resonates deeply, as the program is not just about individuals—it’s a collective promise to ensure that every Canadian can retire with dignity.

Looking Ahead

In the years to come, policymakers will likely face mounting pressures to adapt the CPP in responses to changing economic trends and demographic shifts. Creating a system that not only preserves the value of retirement benefits but also promotes greater financial equity will be critical. As we continue to navigate these complex issues together, one thing remains clear: the Canada Pension Plan will play a pivotal role in shaping the future lives of Canadians.